Kuwait Indemnity Calculator 2026: How to Do Calculation

Using Kuwait Indemnity Calculator helps you determine the amount of Indemnity you will receive based on your number of years of service, the number of paid leave accrued, and your monthly salary.

Table Of Contents

- 1 Kuwait Indemnity Calculator

- 2 How to Use Kuwait Indemnity Calculator

- 3 Kuwait Labor Law and Indemnity

- 4 Who is entitled to Indemnity Benefits in Kuwait

- 5 Key Components of Kuwait Indemnity Calculator

- 6 Steps to Calculate Your Indemnity in Kuwait

- 7 Indemnity Calculation Formula in Kuwait for the government sector

- 8 Deducting Part of Indemnity Cases in Kuwait

- 9 Cases of Indemnity Eligibility in Kuwait

- 10 Calculation of Indemnity According to Kuwait Labor Law by Example

- 11 The Importance of Kuwait Indemnity Calculator

- 12 Essential Legal Terms Regarding Kuwait Indemnity

- 13 Considerations and Exceptions in Kuwait Indemnity

- 14 Questions & Answers

- 14.1 What is the Kuwait Indemnity Calculator?

- 14.2 How does the Kuwait Indemnity Calculator work?

- 14.3 Who can use the Kuwait Indemnity Calculator?

- 14.4 Who is entitled to indemnity in Kuwait?

- 14.5 What factors affect my indemnity amount in Kuwait?

- 14.6 Where can I find more resources about labor laws in Kuwait?

Kuwait Indemnity Calculator

You can use the following Indemnity calculator to calculate your end of service gratuity:

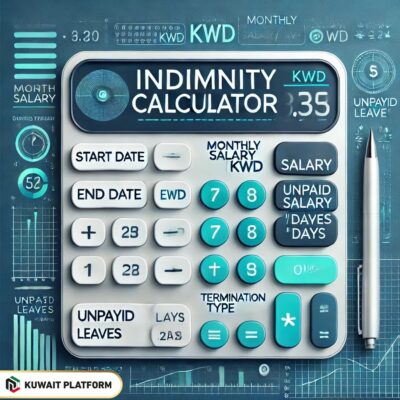

How to Use Kuwait Indemnity Calculator

You can use the Kuwait Indemnity Calculator by following these simple steps:

- Step 1: Go to the Kuwait Indemnity Calculator.

- Step 2: Select your start date according to the calendar used in the calculator.

- Step 3: Select your end of service date according to the calendar used in the calculator.

- Step 4: Input your monthly salary upon termination of their contract.

- Step 5: Input the number of unpaid leave days.

- Step 6: Click the “Calculate Indemnity” button.

Kuwait Labor Law and Indemnity

The current Kuwaiti Labor Law includes all the details related to Indemnity in Chapter Three, which begins with Article 41 and continues through Article 54. This means that 14 articles are derived from the law, including the method of calculating the gratuity and the cases in which an employee is deprived of it.

Who is entitled to Indemnity Benefits in Kuwait

All private sector employees in Kuwait are entitled to end-of-service benefits upon the expiration of their contract for the specified period, or upon termination of the contract for reasons related to the employer, as determined by the Kuwaiti Labor Law.

Key Components of Kuwait Indemnity Calculator

The following are the elements upon which indemnity calculation in Kuwait depends:

- Number of years of service: The value of indemnity in Kuwait varies depending on the number of years of service. An employee may not be entitled to the full gratuity if they terminate their contract before 10 years of service with the same employer.

- Monthly salary value: The value of the indemnity in Kuwait increases with the increase in the employee’s monthly salary, while its value decreases with the decrease in the salary of an employee working in the private sector.

- Reason for termination of the employment contract: The value of indemnity varies depending on the reason for terminating the employment contract. The current labor law in Kuwait stipulates several cases in which an employee is deprived of the gratuity, in whole or in part.

- Number of paid leave days: An employee receives a gratuity for the days of paid vacation they have not taken, according to the Kuwaiti labor law. Therefore, the number of vacation days significantly affects the value of the gratuity.

Steps to Calculate Your Indemnity in Kuwait

You can calculate your indemnity in Kuwait based on length of service, in addition to many other details. Here’s how to calculate your indemnity :

Calculate Kuwait Indemnity for the First Five Years

You can calculate Kuwait indemnity for the first five years, follow these simple steps:

- Indemnity for the First Five Years = (Daily Salary × 15) × Number of Years

Calculate Kuwait Indemnity for Years Exceeding Five

To calculate Kuwait indemnity for years exceeding five, follow these simple steps:

- Indemnity for Years Exceeding Five = (Daily Salary × 30) × Number of Exceeding Years

Calculate Kuwait Indemnity for Months and Days Beyond Full Years

You can calculate Kuwait indemnity for months and days beyond full years, follow these easy steps:

- For service less than 5 years:

- Monthly Indemnity = (Number of Months ÷ 12) × (Daily Salary × 15)

- Daily Indemnity = (Number of Days ÷ 365) × (Daily Salary × 15)

- For service more than 5 years:

- Monthly Indemnity = (Number of Months ÷ 12) × (Daily Salary × 30)

- Daily Indemnity = (Number of Days ÷ 365) × (Daily Salary × 30)

Calculate Paid Leave Balance for Indemnity in Kuwait

To calculate paid leave balance for indemnity in Kuwait, follow these simple steps:

- Paid Leave Balance Amount for Indemnity = (Number of Paid Leave Days) × Daily Salary

Calculate Total Indemnity in Kuwait

You can calculate Total indemnity in Kuwait, follow these simple steps:

- Total Indemnity = First 5 Years Indemnity + Exceeding Years Indemnity + Monthly Indemnity + Daily Indemnity + Paid Leave Balance Amount

Indemnity Calculation Formula in Kuwait for the government sector

The following table shows how to calculate indemnity in Kuwait for the government sector:

| Category | Indemnity Calculation Method |

| About the first 5 years, for those who do not deserve a pension. | Pension settlement salary×12×10% ×5 |

| About the second 5 years, for those who do not deserve a pension. | Pension settlement salary×12×12% ×5 |

| About the third 5 years, for those who do not deserve a pension. | Pension settlement salary×12×15% ×5 |

| For the years following the first 15 years of service, for those who do not deserve a pension. | Pension settlement salary×12×20% ×5 |

| Male pensioners up to the age of 55, for those who are entitled to a pension. | One full month’s salary for each year of subscription, provided that it does not exceed 18 months. |

| Female pensioners up to the age of 50, for those who are entitled to a pension. | One full month’s salary for each year of subscription, provided that it does not exceed 18 months. |

| Male pensioners up to the age of 56, for those who are entitled to a pension. | Salary of 19 months |

| Female pensioners up to the age of 51, for those who are entitled to a pension. | Salary of 19 months |

| Male pensioners up to the age of 57, for those who are entitled to a pension. | Salary of 20 months |

| Female pensioners up to the age of 52, for those who are entitled to a pension. | Salary of 20 months |

| Male pensioners up to the age of 58, for those who are entitled to a pension. | Salary of 21 months |

| Female pensioners up to the age of 53, for those who are entitled to a pension. | Salary of 21 months |

| Male pensioners over the age of 58, for those who are entitled to a pension. | Salary of 21 months |

| Female pensioners over the age of 53, for those who are entitled to a pension. | Salary of 21 months |

Deducting Part of Indemnity Cases in Kuwait

The following table shows cases of deducting part of the indemnity in Kuwait:

| Duration of service | Indemnity deduction |

| The worker terminates the unlimited period contract from his own part, and the term of his service is not less than 3 years and did not complete 5 years. | Half of indemnity is deducted. |

| The worker terminates the unlimited period contract from his own part, and the term of his service is not less than 5 years and did not complete 10 years. | One third of indemnity is deducted. |

| The worker terminates the unlimited period contract from his own part, and the term of his service is not less than 10 years | No deduction from indemnity |

Cases of Indemnity Eligibility in Kuwait

An employee is entitled to indemnity upon termination of his or her employment in Kuwait in any of the following cases:

- The employer fails to comply with the terms of the contract and the provisions of the Labor Law.

- The employer or his or her representative assaults the employee.

- The employee’s continued employment is harmful to his or her health, based on a report from the Medical Arbitration Committee at the Ministry of Health.

- The employee is acquitted of a punishable offense brought against him or her by the employer.

- The employer commits acts against the employee that violate public morals.

- The employee dies, becomes unable to continue working, or becomes ill after exhausting his or her sick leave.

- The issuance of a judgment declaring the employer bankrupt.

- The establishment is permanently closed.

- The employer terminates the employment contract.

- The expiration of the employment contract without renewal. The employee’s employment contract terminates due to her marriage within one year of the marriage.

Calculation of Indemnity According to Kuwait Labor Law by Example

Suppose Mahmoud has worked for a private company in Kuwait for 8 years, 8 months, and 22 days. His monthly salary is 1,500 Kuwaiti dinars, and he has 13 days of unused paid leave. What is the compensation amount in this case?

- Daily salary = 1500 KWD ÷ 26 days = 57.69 KWD

- Indemnity for the first five years = (57.69 KWD × 15) × 5 years = 4326.75 KWD

- Indemnity for years exceeding five years = (57.69 KWD × 13) × 3 = 2249.91 KWD

- Monthly bonus = (8 months ÷ 12 months) × (57.69 KWD × 13) = 499.98 KWD

- Daily Indemnity = (22 days ÷ 365 days) × (57.69 KWD × 13) = 45.20 KWD

- Paid leave balance for Indemnity = (13 days) × 57.69 KWD = 749.97 KWD

- Total Indemnity = 2249.91 KWD + 4326.75 KWD + 499.98 KWD + 45.20 KWD + 749.97 KWD = 7871.81 KWD

The Importance of Kuwait Indemnity Calculator

The benefits of using an indemnity calculator in Kuwait can be identified as follows:

- Transparency: Helps you understand your employee’s end-of-service rights.

- Preparing for end-of-service benefits: Knowing what an employee will receive at the end of their service helps you prepare for retirement.

- Understanding rights and obligations: Helps you understand your rights at the end of your service.

Essential Legal Terms Regarding Kuwait Indemnity

There are several legal terms you should know about retirement and employee rights, including:

- Labor Law: The law that governs the employee’s relationship with management.

- Retirement: The state of ceasing employment upon reaching retirement age.

- Salary Certificate: A document detailing an employee’s entitlements.

- Basic Salary: The amount of the salary without any additions or deductions.

- Length of Service: The number of years an employee has served with the company.

Considerations and Exceptions in Kuwait Indemnity

There are some exceptions and adjustments that should be taken into account when calculating indemnity, including:

- Resignation: Employees typically receive half their salary for each year of service if they resign before completing five years.

- Non-fault termination: Compensation is typically half a month’s salary for the first five years and a full month’s salary for each additional year.

- Fault termination: Compensation is typically not granted, but this may vary depending on the contract or company policy.

- Over five years of service: After five years, compensation is converted to a full month’s salary for each additional year.

- Adjustments: Calculations may be adjusted based on specific employment contracts, company policies, or additional benefits offered by the employer.

Conclusion

Kuwaiti Labor Law guarantees the right of workers to receive indemnity upon the expiration of their contract or termination for one of the reasons specified by law. A portion of the gratuity may be received if the worker terminates the contract after at least three years of employment.

Questions & Answers

What is the Kuwait Indemnity Calculator?

Kuwait Indemnity Calculator helps determine the compensation employees are entitled to upon leaving a job in Kuwait, based on salary and years of service.

How does the Kuwait Indemnity Calculator work?

Kuwait Indemnity Calculator formula is: Monthly Salary × 15 days/year (first 5 years) or 30 days/year (beyond 5 years).

Who can use the Kuwait Indemnity Calculator?

Employees, HR professionals, and employers can use Kuwait Indemnity Calculator for calculating or verifying indemnity amounts.

Who is entitled to indemnity in Kuwait?

All private sector employees are entitled to termination indemnity.

What factors affect my indemnity amount in Kuwait?

Factors include monthly salary, years of service, and any unused paid leave.

Where can I find more resources about labor laws in Kuwait?

Visit the Ministry of Social Affairs and Labor website.